Basic information about Commercial Invoice

A commercial invoice is a crucial document used in international trade. A commercial invoice is a required document for the export and import clearance process. It is sometimes used for foreign exchange purposes.

Purpose and Importance:

- A commercial invoice serves as a request for payment for goods sold internationally.

- It is required by customs to determine applicable taxes, tariffs, or duties for imported goods.

- Customs authorities use it to prevent any delays during the import process.

When Is It Required?

- A commercial invoice is mandatory for shipments across international borders.

- For example, when shipping from the US to Canada, the US to the EU, or any other international destination, you must attach a commercial invoice.

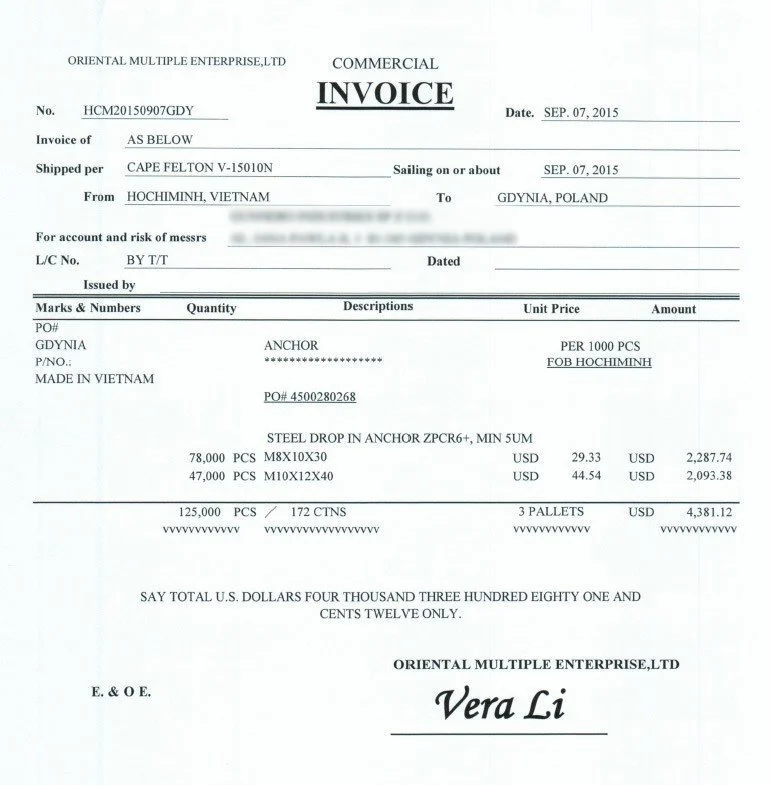

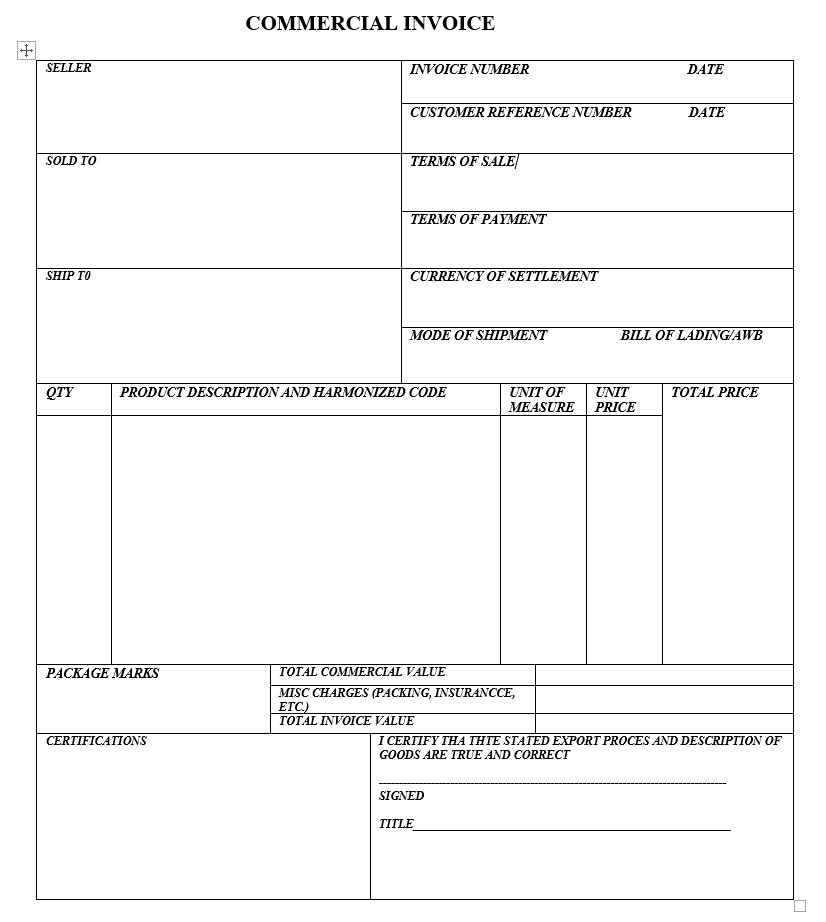

Key Elements of a Commercial Invoice:

- Header: Includes contact information for both the buyer (importer) and the seller (exporter).

- Product Details:

- Country of Origin: Where the goods were manufactured or produced.

- Harmonized System (HS) Code: A standardized code that classifies products for customs purposes.

- Product List: Describes the items being shipped.

- Payment Terms: Specifies how and when payment is expected.

- Freight Terms: Details the shipping terms (e.g., FOB, CIF).

- Other Relevant Information: Any additional details necessary for customs clearance.

Proforma Invoice vs Commercial Invoice:

- Before issuing a commercial invoice, businesses often send a proforma invoice.

- The proforma invoice provides the buyer with an estimate of the final invoice cost and delivery timing.

- Unlike the commercial invoice, the proforma invoice does not serve as a request for payment.

How to create one

Header Information:

- Start by including your company’s details (the seller/exporter) and the recipient’s details (the buyer/importer). Include the following:

- Your Company Name and Address: Clearly state your business name, address, and contact information.

- Buyer’s Company Name and Address: Include the recipient’s company name, address, and contact details.

Invoice Number and Date:

- Assign a unique invoice number to this transaction.

- Specify the date when the invoice was issued.

Product Details:

- List the items being shipped. Include the following for each product:

- Description: A brief description of the product.

- Quantity: The number of units being shipped.

- Unit Price: The price per unit.

- Total Price: Multiply the quantity by the unit price to calculate the total cost for each item.

Currency and Payment Terms:

- Indicate the currency in which the transaction is conducted (e.g., USD, EUR, JPY).

- Clearly state the payment terms (e.g., “Payment due within 30 days from the invoice date”).

Shipping and Freight Details:

- Specify the shipping terms (e.g., FOB, CIF).

- Include any freight charges or shipping costs.

Country of Origin and HS Code:

- Mention the country where the goods were manufactured or produced.

- Assign the appropriate Harmonized System (HS) code for each product. This code helps customs classify the goods.

Additional Notes:

Add any relevant information, such as special instructions, terms, or conditions.

Sign and Date:

- Sign the invoice to validate it.

- Include the date of issuance.

It’s also important to keep copies of your commercial invoices for your records and for customs purposes.

You might also be interested in: